Introduction

Dollar Cost Averaging (DCA) is an investment strategy that involves regularly investing a fixed amount of money in a particular asset over a long period of time. This approach aims to reduce the impact of market volatility and allows investors to buy more shares when prices are low and fewer shares when prices are high.

In this article, we will delve into the definition and basic principles of Dollar Cost Averaging, explore its advantages in managing market fluctuations, highlight the importance of reducing market risk through regular investments, discuss its effectiveness in achieving favorable average purchase costs, outline the steps to implement DCA, provide an example to demonstrate its potential, emphasize the importance of rational investment decisions and long-term holding, and conclude with a reminder to align market risks with individual investment goals.

Understanding Dollar Cost Averaging

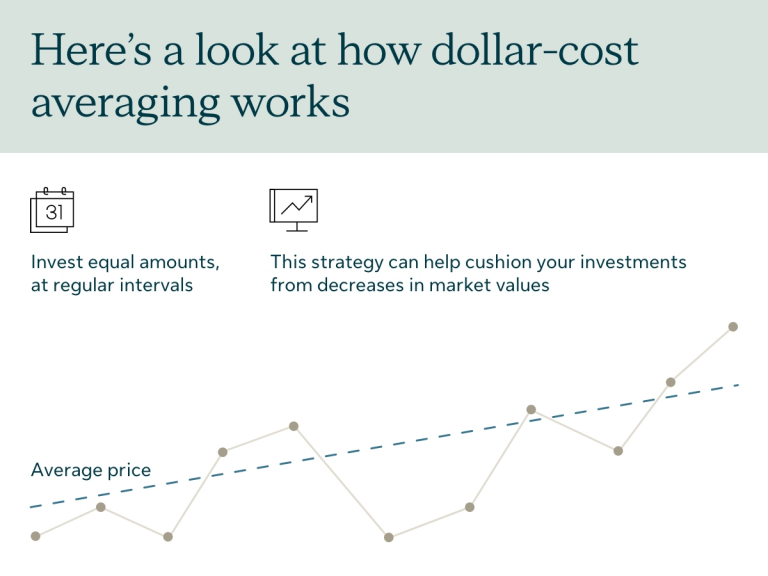

Dollar Cost Averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s current price. By adhering to a consistent investment schedule, investors can capitalize on the fluctuations of the market. When prices are high, the fixed investment amount will purchase fewer shares, and when prices are low, the same investment amount will buy more shares. This approach helps to smooth out the impact of short-term market volatility and allows investors to accumulate assets over time.

Advantages of Dollar Cost Averaging

Managing Market Fluctuations

One of the key advantages of Dollar Cost Averaging is its ability to mitigate the impact of market fluctuations. By consistently investing a fixed amount, investors buy more shares when prices are low and fewer shares when prices are high. This approach removes the need to time the market, as the focus is on the long-term accumulation of assets rather than short-term price fluctuations.

Regular Investments

Regular investments are crucial in reducing market risk. By investing at regular intervals, investors automatically buy assets at different price points, effectively averaging out the purchase cost. This approach reduces the impact of market highs and lows and helps investors avoid making emotional decisions based on short-term market movements.

Achieving Favorable Average Purchase Costs

Dollar Cost Averaging allows investors to achieve favorable average purchase costs over the long term. This approach ensures that the average purchase cost remains relatively stable, providing a solid foundation for long-term investment growth.

Disciplined Investing Approach

By committing to regular investments, investors take emotions and market timing out of the equation. This reduces the likelihood of making impulsive investment decisions based on short-term market movements. Instead, investors focus on the long-term accumulation of assets, aligning their investment strategy with their financial goals and risk tolerance.

Implementing Dollar Cost Averaging

Developing a Regular Investment Plan

To implement Dollar Cost Averaging effectively, it is essential to develop a regular investment plan. This involves:

- Determining the amount to invest.

- The frequency of investments.

- The duration of the investment period.

Investors should consider their financial goals, risk tolerance, and available funds when formulating their investment plan.

Consistency and Long-Term Benefits

Consistency is key when implementing Dollar Cost Averaging. Investors should stick to their investment plan regardless of market conditions. By maintaining discipline and continuing to invest regularly, investors can benefit from the long-term advantages of Dollar Cost Averaging, such as reduced market risk and favorable average purchase costs.

Examples

Dollar Cost Averaging has proven to be a successful investment strategy for many individuals.

For instance, if you earn $2,000 monthly and allocate $200 of the salary to your pension plan. Out of the $200, you could opt to invest £100 in an S&P 500 index fund and £100 in another mutual fund.

Every month, $200 will be deducted from your salary and invested in the two funds, no matter the price. You will invest during the market highs and lows over the year; hence, the term “Dollar Cost Averaging”, i.e. the prices you paid average out over time.

For another example, consider an investor who implemented DCA by regularly investing $100 in a particular stock weekly over a five-year period. Despite fluctuations in the stock’s price, the investor accumulated a significant number of shares. Over time, the average purchase cost of the shares remained relatively stable, resulting in considerable investment growth. Naturally, in a market that historically rose over time, the investor would gain more returns eventually.

Be aware that many of the stocks that dropped in a bear market never recover and get replaced by other successful companies. So choose your stocks wisely.

To fully benefit from Dollar Cost Averaging, it is essential to make rational investment decisions and adopt a long-term holding perspective. Emotional reactions to short-term market fluctuations can lead to poor investment choices. By focusing on the long-term and holding investments for a considerable period, investors can ride out market volatility and potentially achieve significant investment growth.

Conclusion

Dollar Cost Averaging is an investment strategy that allows investors to accumulate assets over time while reducing the impact of market volatility. By consistently investing a fixed amount, investors can manage market fluctuations, achieve favorable average purchase costs, and reduce market risk.

Implementing Dollar Cost Averaging requires developing a regular investment plan, maintaining consistency, making rational investment decisions, and adopting a long-term holding perspective. It is important for investors to remember that market risks should align with their individual investment goals, and seeking professional advice is always advisable.